The Government of Vietnam has officially introduced a 3-year Corporate Income Tax (CIT) exemption for newly established small and medium-sized enterprises (SMEs). In addition, flexible CIT rates of 15%, 17%, and 20% will be applied based on the size and revenue scale of enterprises.

Further tax exemptions and reductions are available for businesses operating in incentivized industries and priority locations.

Entrepreneurs and enterprises are strongly advised to carefully review and apply these tax policies to benefit from the most favorable and lawful tax treatment.

These incentives are stipulated under National Assembly Resolution No. 198/2025/QH15, the Law on Corporate Income Tax, and are further detailed in Decree No. 320/2025/ND-CP and Decree No. 20/2026/ND-CP.

I. CORPORATE INCOME TAX EXEMPTION FOR SMALL AND MEDIUM-SIZED ENTERPRISES

Previously, tax incentives were mainly granted to FDI enterprises, specific industries, or businesses operating in disadvantaged areas. Under the new policy, all newly established SMEs are eligible for special tax incentives.

Accordingly, newly established SMEs are exempt from Corporate Income Tax for the first three (3) years.

This incentive also applies to enterprises established before May 17, 2025, provided they are still within the eligible incentive period, allowing them to enjoy tax exemption for the remaining eligible duration.

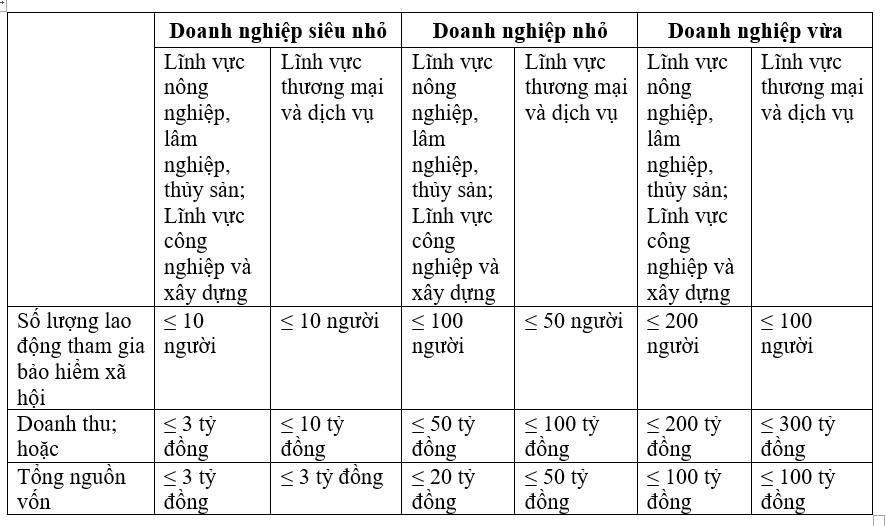

Criteria for determining SMEs:

(As defined under current regulations – see attached reference image.)

Exclusion Cases:

The tax exemption does not apply to:

-

Enterprises established through mergers, consolidations, divisions, separations, ownership transfers, or changes in business type;

-

Newly established enterprises where the legal representative (except non-capital-contributing representatives), general partners, or the largest capital contributors have participated in other businesses that are still operating or were dissolved less than 12 months prior to the establishment of the new enterprise;

-

Income derived from:

-

Capital transfers or capital contribution transfers;

-

Real estate transfers (except for social housing projects);

-

Investment project transfers (except mineral processing projects);

-

Overseas business activities;

-

Oil and gas exploration, mining, and rare natural resource exploitation;

-

Online gaming businesses;

-

Production or trading of goods and services subject to Special Consumption Tax (except for automobile, aircraft, helicopter, yacht manufacturing and oil refining);

-

Other special cases as stipulated by the Government.

-

II. FLEXIBLE CORPORATE INCOME TAX RATES BASED ON ENTERPRISE SIZE

From the 2025 tax year, Corporate Income Tax rates will be applied based on annual revenue as follows:

-

Standard rate: over 20%

-

17% rate: annual revenue from VND 3 billion to under VND 50 billion

-

15% rate: annual revenue not exceeding VND 3 billion

Note:

Subsidiaries or enterprises in affiliated relationships are not eligible for the 15% or 17% rates if the affiliated enterprises do not meet the required criteria.

A preferential tax rate of 10% applies for the entire operating period or for 15 years to enterprises:

-

Investing in areas with extremely difficult socio-economic conditions;

-

Operating in priority industries;

-

Developing social housing projects;

-

Engaging in socialized sectors;

-

Applying high technology, venture capital for high-tech development;

-

Producing software, cybersecurity products, supporting industries, and other prioritized sectors.

III. APPLICATION OF TAX INCENTIVES, EXEMPTIONS, AND REDUCTIONS

-

Abolition of the former “2-year exemption and 4-year reduction” policy for enterprises in Industrial Zones;

-

Application of 4-year tax exemption and 50% reduction for the subsequent 9 years for enterprises eligible for the 10% CIT rate over 15 years, including:

-

Socialized enterprises in selected sectors operating in disadvantaged or extremely disadvantaged areas;

-

New projects in high-tech zones and economic zones;

-

-

Application of 2-year tax exemption and 50% reduction for the following 4 years for entities stipulated under Decree No. 320/2026/ND-CP.

(For detailed eligibility and conditions, enterprises are advised to refer directly to Decree No. 320/ND-CP.)