Vietnam Report Releases 2025 Rankings of Top Real Estate Companies as Market Enters New Growth Cycle

On March 21, 2025, Vietnam Report Joint Stock Company officially announced its annual ranking of the Top 10 Reputable Real Estate Companies in 2025, recognizing standout enterprises across three key segments: real estate investment, industrial real estate, and real estate services.

This annual ranking is the result of independent research conducted by Vietnam Report using objective, data-driven methodologies. It highlights companies that have demonstrated exceptional resilience, financial strength, product quality, and brand reputation in a recovering market. The evaluation was based on Vietnam Report’s extensive business database, analyzing financial data through December 31, 2024, alongside media monitoring, and survey feedback from stakeholders and industry experts.

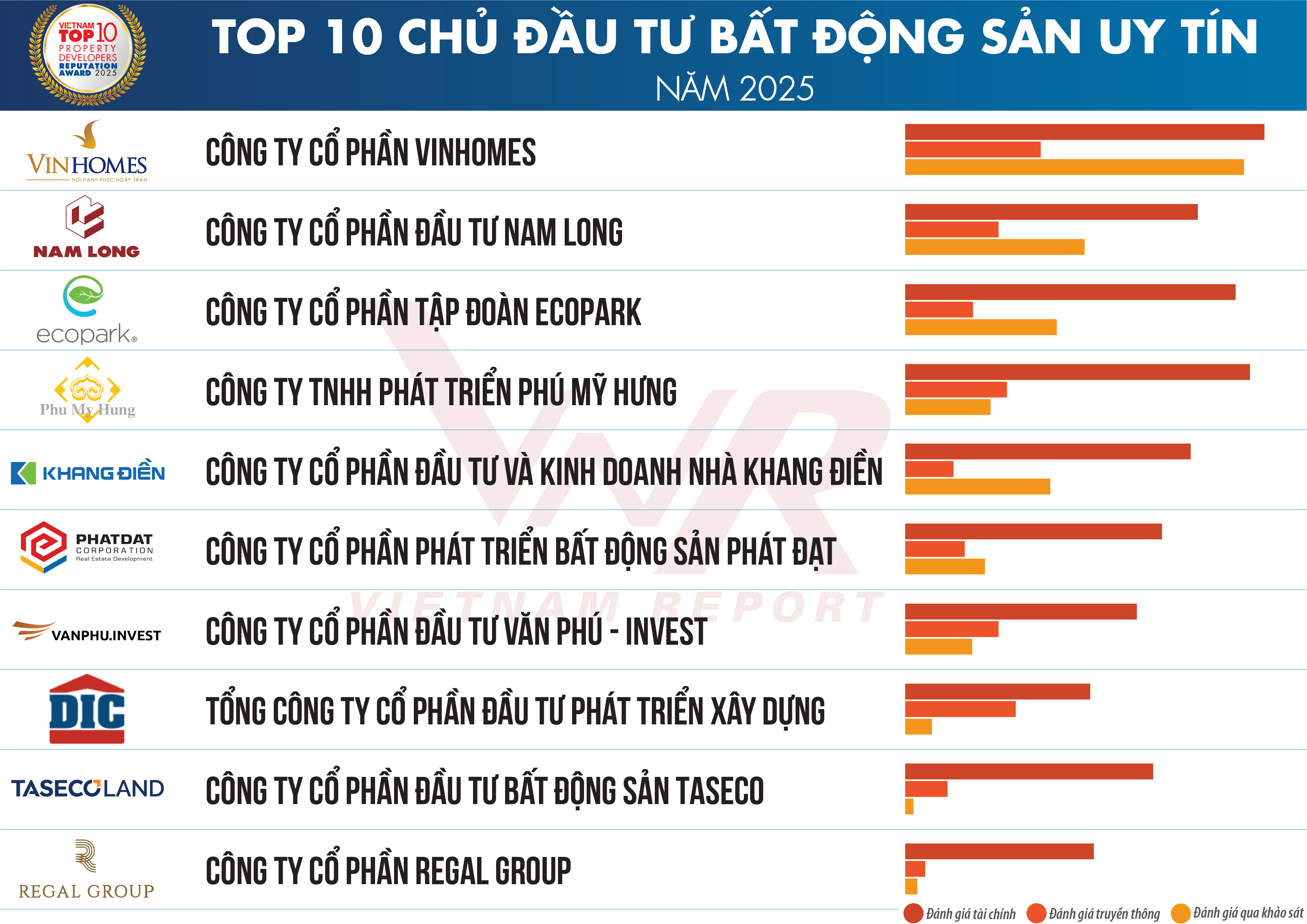

List 1: Top 10 Reputable Real Estate Investors in 2025

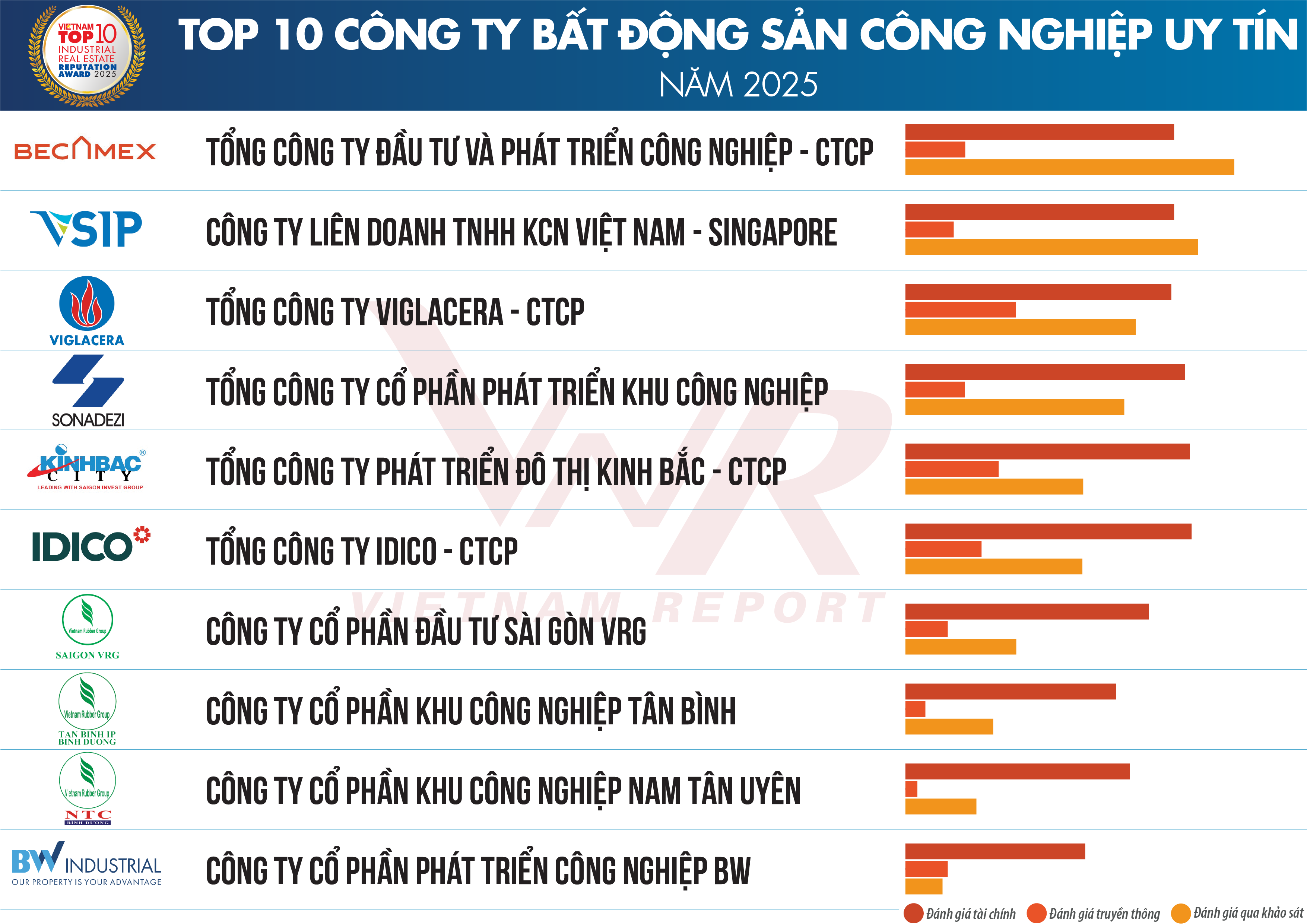

List 2: Top 10 Reputable Industrial Real Estate Companies in 2025

List 3: Top 10 Reputable Real Estate Service Companies in 2025 (Consulting, Development, and Operations Management)

Source: Vietnam Report, March 2025

Vietnam Real Estate in 2024: A Year of Recovery and Transition

After a prolonged downturn from late 2022 through 2023, Vietnam’s real estate sector began to show promising signs of recovery in 2024. The year marked a turning point—driven by robust government policy interventions and improved macroeconomic conditions—ushering the industry into a new growth phase.

Legal bottlenecks that once stalled developments were addressed through the Government’s Resolution No. 33/NQ-CP, aimed at fostering a safe, transparent, and sustainable real estate environment. Licensing activity improved significantly, especially in early 2024, enabling a rise in both new housing projects and completions. By the end of the year, 38,345 new housing units were licensed—up 53.4% year-over-year—while 76,272 units were completed or deemed eligible for sale, despite a slight decline of 7.3% compared to 2023.

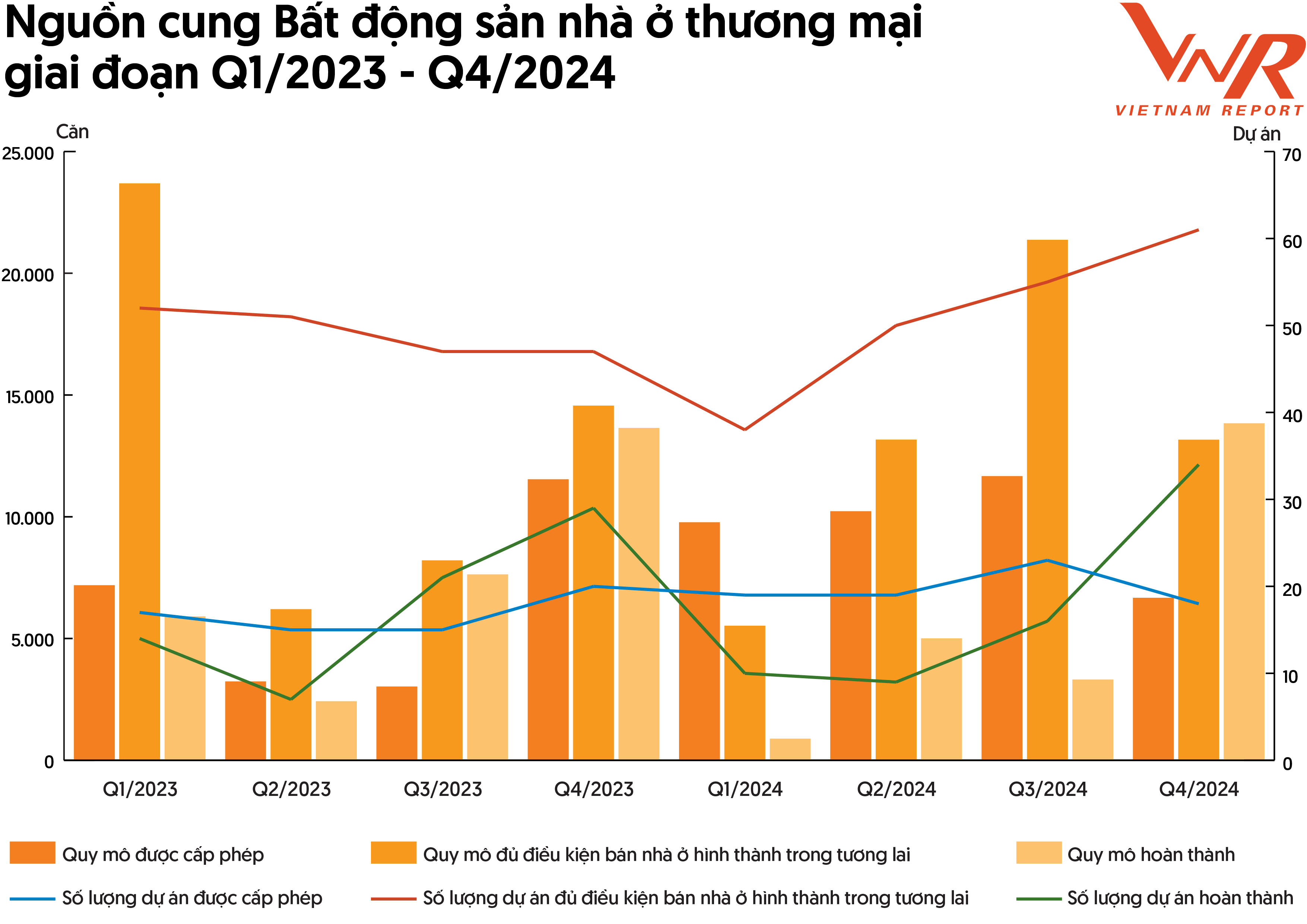

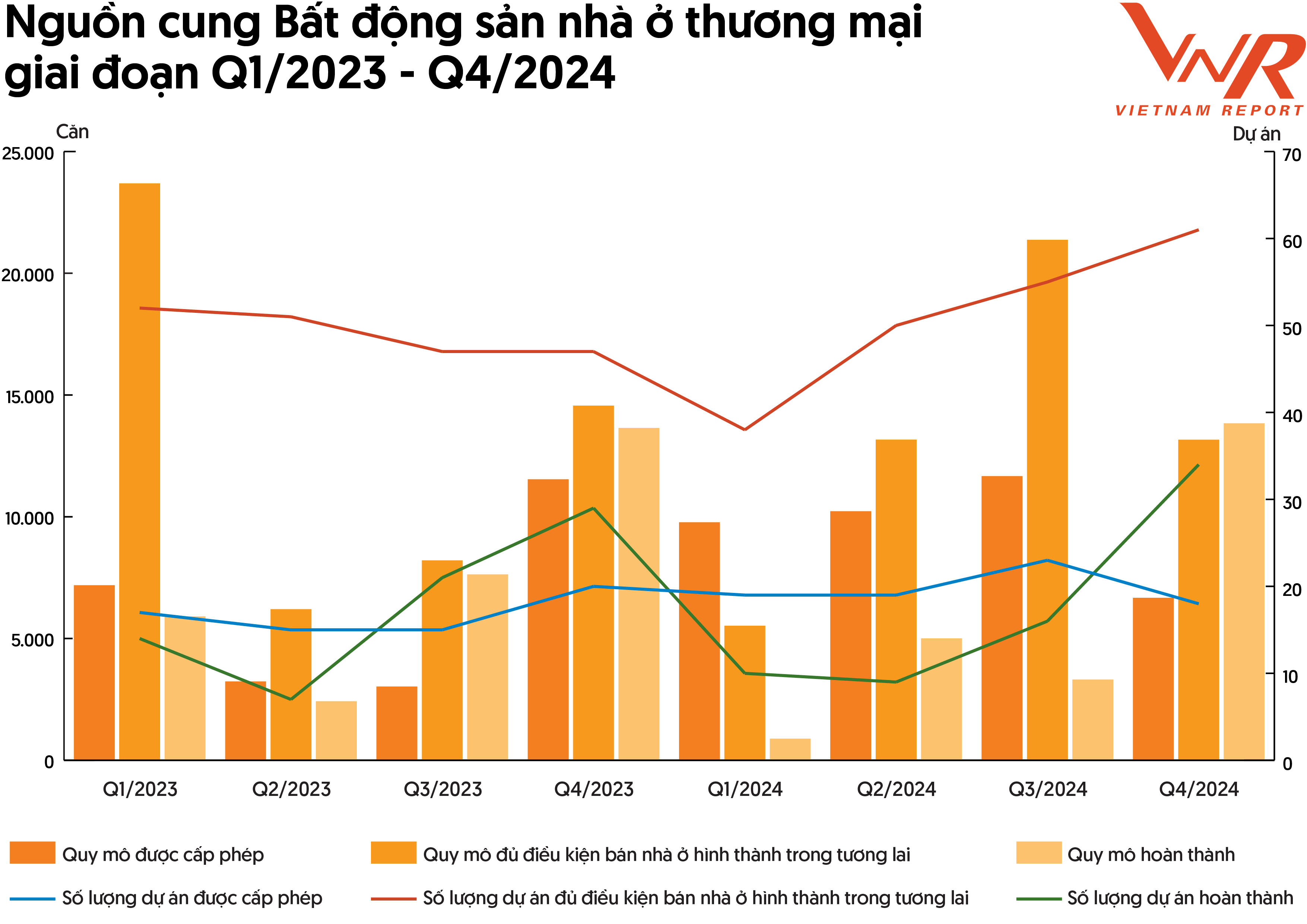

Figure 1: Supply of Commercial Housing (Q1/2023 – Q4/2024)

Source: Ministry of Construction

Transaction volumes also saw a notable rebound. The market bottomed out in Q2/2023, then surged in Q2/2024 with 150,876 property transactions—a 55.6% increase year-on-year, though still just over half of Q2/2022’s peak. Land plots led the rebound, with a 34.2% jump in transactions across the year, contributing to an overall 24.1% increase in total deals.

Figure 2: Real Estate Transactions by Type (Q1/2022 – Q4/2024)

Source: Ministry of Construction

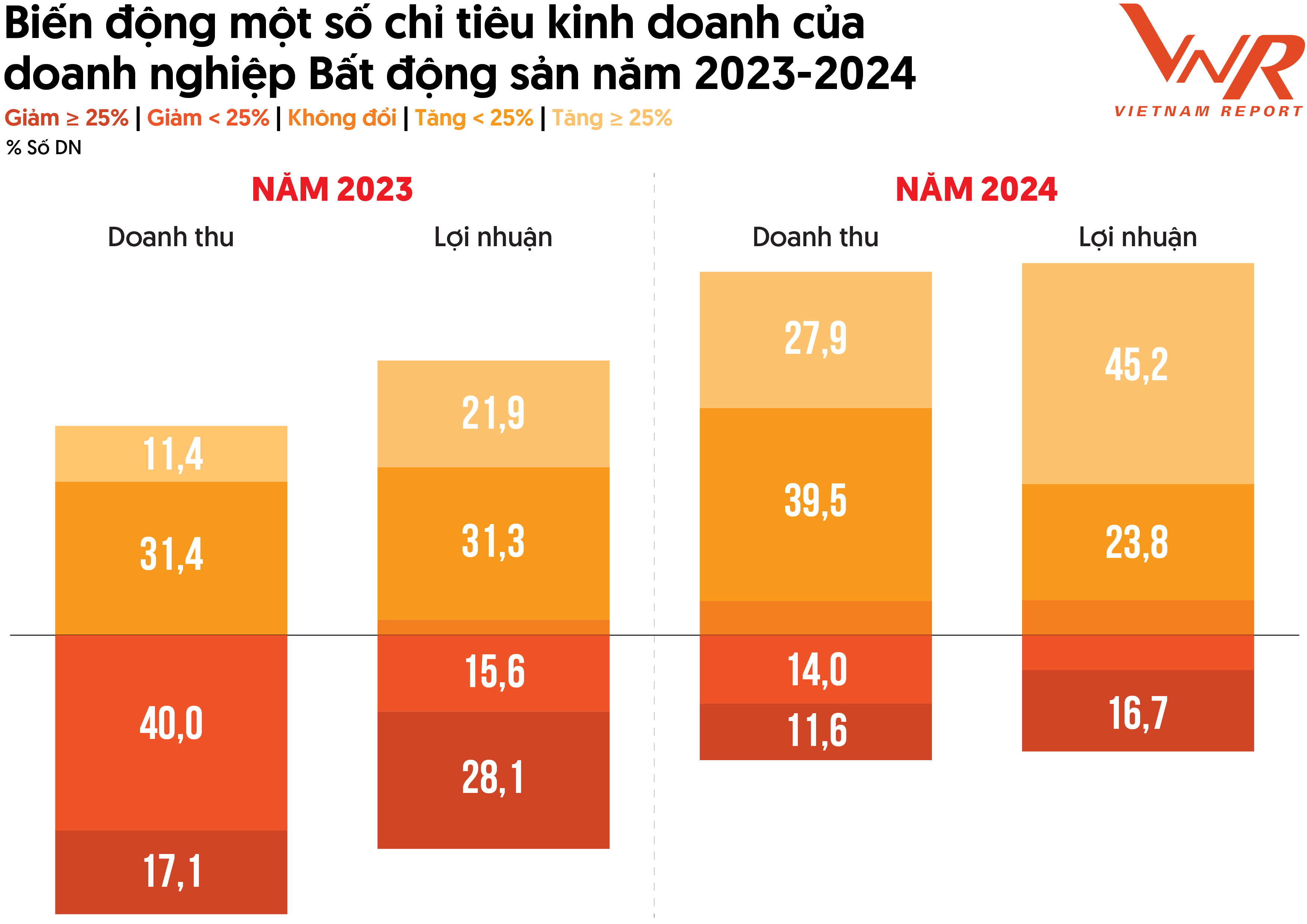

Business sentiment also improved markedly. According to Vietnam Report’s February 2025 survey, the proportion of real estate firms reporting revenue and profit growth rose significantly. Nearly 40% saw revenue growth below 25%, while 28% exceeded that mark. Notably, 45.2% of firms posted profit growth above 25%—a testament to leaner operations and adaptive strategies. Government data also confirmed a 42.2% increase in businesses returning to operation in 2024, with new market entrants outnumbering exits by 41.6%.

Figure 3: Business Performance Indicators (2023–2024)

Source: Vietnam Report

Outlook for 2025: Building Momentum Toward a New Growth Phase

Looking ahead, 2025 is poised to become a transformative year for Vietnam’s real estate industry. The market is entering a crucial phase of consolidation and expansion, powered by a confluence of economic growth, legal reforms, infrastructure development, and digital transformation.

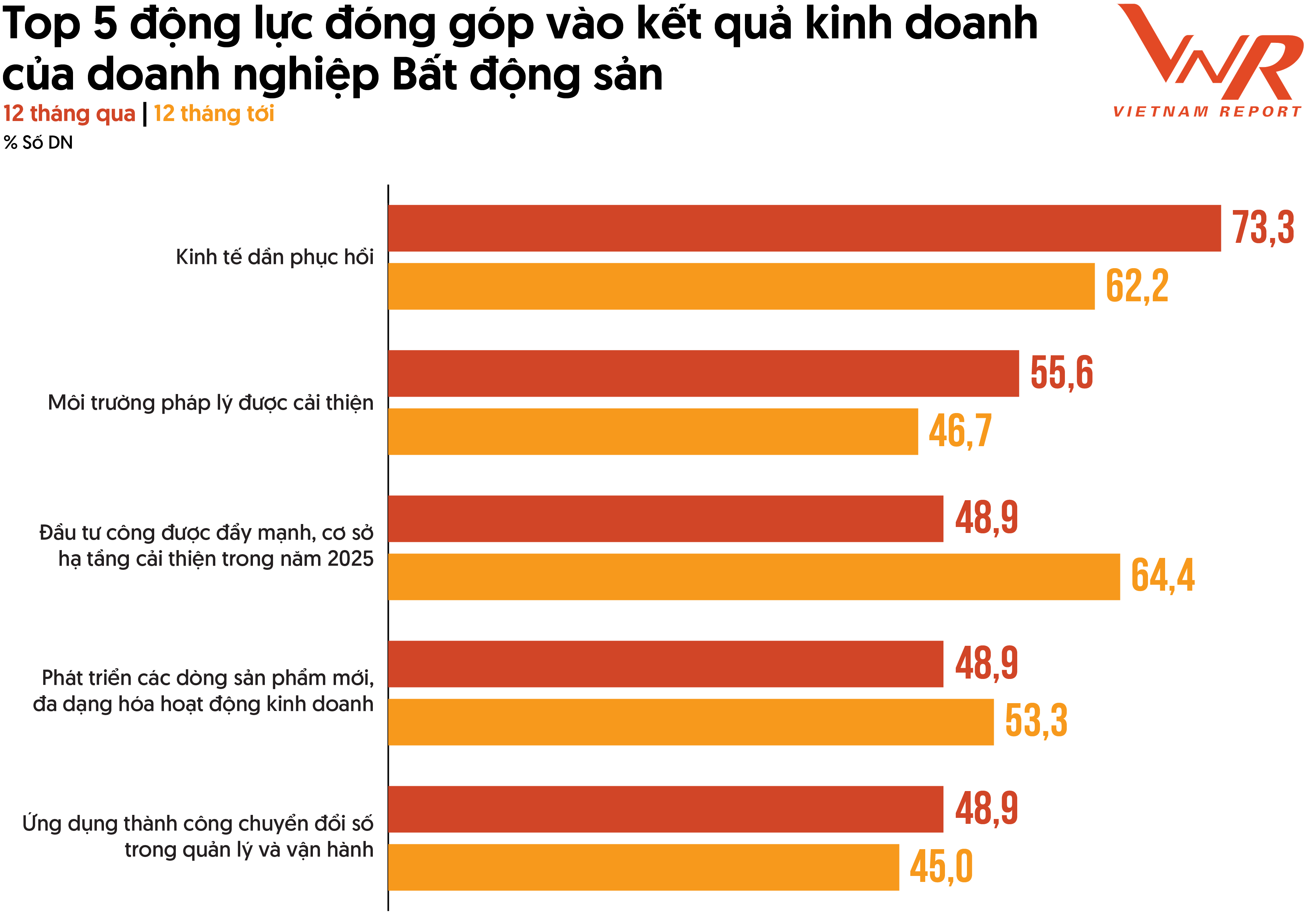

Figure 4: Top 5 Drivers of Real Estate Business Performance

Source: Vietnam Report, 2025

At the forefront is Vietnam’s economic rebound. Following GDP growth of 7.09% in 2024, the government is targeting an ambitious 8% in 2025, with a vision of sustained double-digit growth. While this trajectory brings inflationary pressures—estimated at 4.5% for 2025—it also boosts income levels, supporting rising demand for housing, particularly in mid- and low-income segments in major cities. Continued FDI inflows are further driving demand for industrial and worker housing.

Legal reforms, implemented in August 2024 through revisions to the Housing Law, Land Law, and Real Estate Business Law, have already begun reshaping the development landscape. Simplified land procedures, flexible social housing regulations, and stricter transparency requirements are fostering greater buyer confidence and expediting project approvals. In 2024, 210 previously-stalled projects were cleared to resume—most of them residential.

While these changes are leveling the playing field, smaller developers may struggle to meet heightened financial thresholds, leaving large firms to dominate. Still, the legal overhaul has opened doors for foreign investors, improved auction transparency, and laid the groundwork for sustainable market dynamics. The Housing Law’s emphasis on social housing also aims to address the needs of 60–70% of the urban population.

Infrastructure investment is another key catalyst. The government’s record VND 878.3 trillion public investment plan for 2025 includes megaprojects such as the North–South Expressway, Long Thanh Airport, and urban rail systems. These will stimulate real estate development around transportation hubs and new economic zones, reducing speculation and encouraging more balanced growth.

Pricing Remains a Critical Challenge

Despite encouraging signs, real estate pricing continues to pose a major obstacle. Supply remains outpaced by real demand, pushing prices higher in both primary and secondary markets. In 2024, apartment prices in Hanoi surged 40–50% over 2023 levels—higher in select areas—while Ho Chi Minh City saw 20–30% increases. Villas and townhouses experienced milder appreciation.

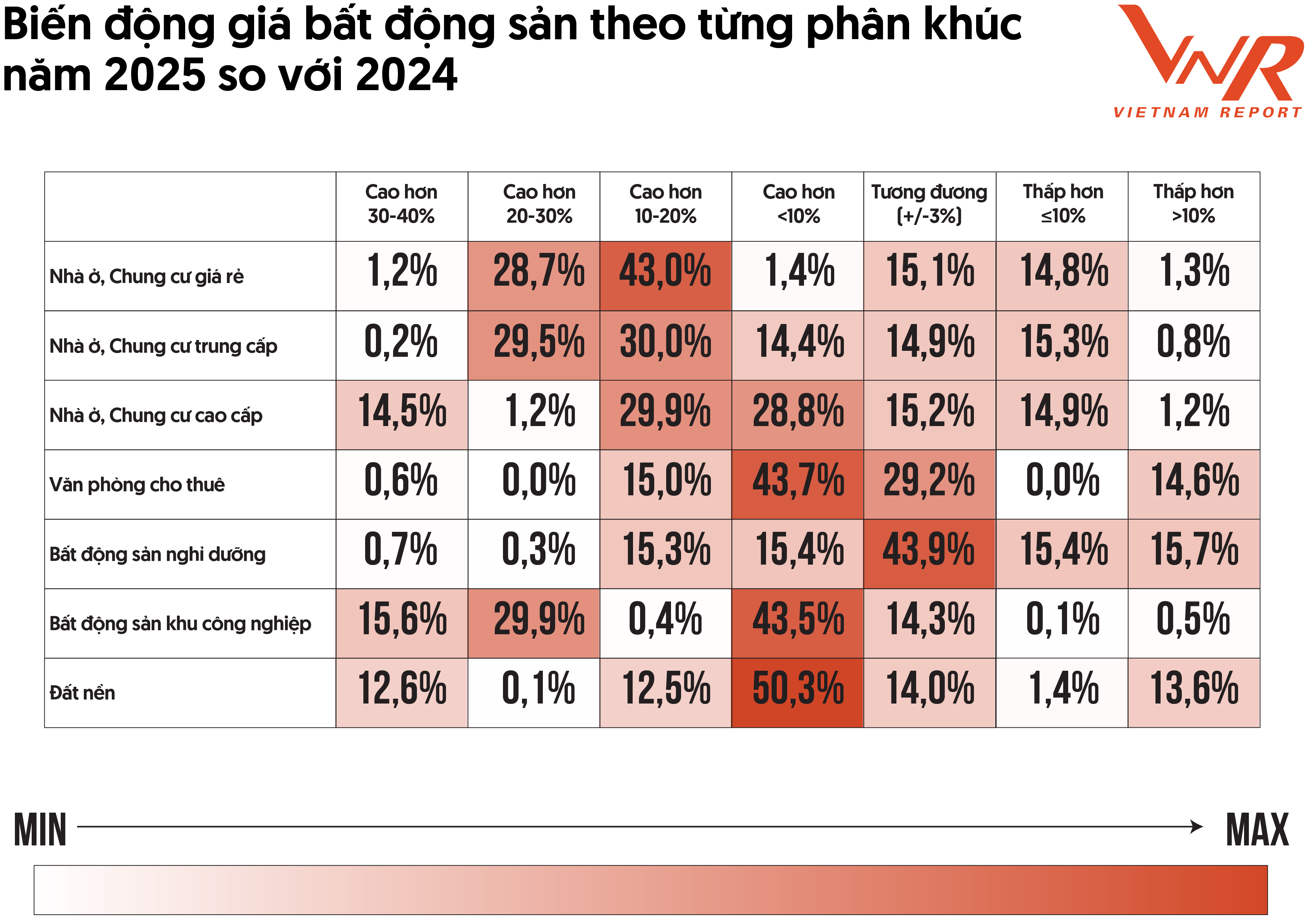

Figure 5: Real Estate Price Changes by Segment (2024 vs. 2025)

Source: Vietnam Report

Surveyed businesses expect further price increases in 2025. Affordable and mid-range housing segments could see the sharpest rise—up to 30%—while high-end apartments, land plots, industrial spaces, and office leases are projected to grow more modestly (under 10%). Resort real estate remains the slowest to recover, with stable or flat pricing expected.

Ongoing administrative restructuring at the provincial level is adding fuel to the fire. As localities merge and new economic centers emerge, land speculation is rising—driving up prices by 20% in some areas even before official announcements. In the medium term, this shift is expected to reshape provincial real estate rankings and attract large-scale investments.

The key to easing pricing pressure lies in boosting supply. Resolution No. 171/2024/QH15 now allows commercial housing to be built on non-residential land under certain conditions—unlocking previously restricted land resources. Repurposing underutilized factory sites and improving urban planning will further help balance supply and demand.

Expanding social housing remains a vital priority. Priced between VND 15–25 million/m², social housing meets the needs of low- and middle-income earners, especially in urban and industrial zones where commercial options are unaffordable. Encouraging public-private partnerships, piloting dedicated real estate funds, and improving design quality are seen as key to unlocking this segment’s potential.

Media Coverage and Reputation: A Crucial Battleground

As the market recovers, reputation and communication strategies have become essential for real estate companies seeking to rebuild trust and strengthen public perception. Vietnam Report used its Media Coding system to track coverage of real estate companies across major media channels from February 2024 to January 2025.

The data revealed that 41.7% of companies achieved strong media visibility, with leading mentions going to Vinhomes, Viglacera, Nam Long, Phát Đạt, and Đất Xanh.

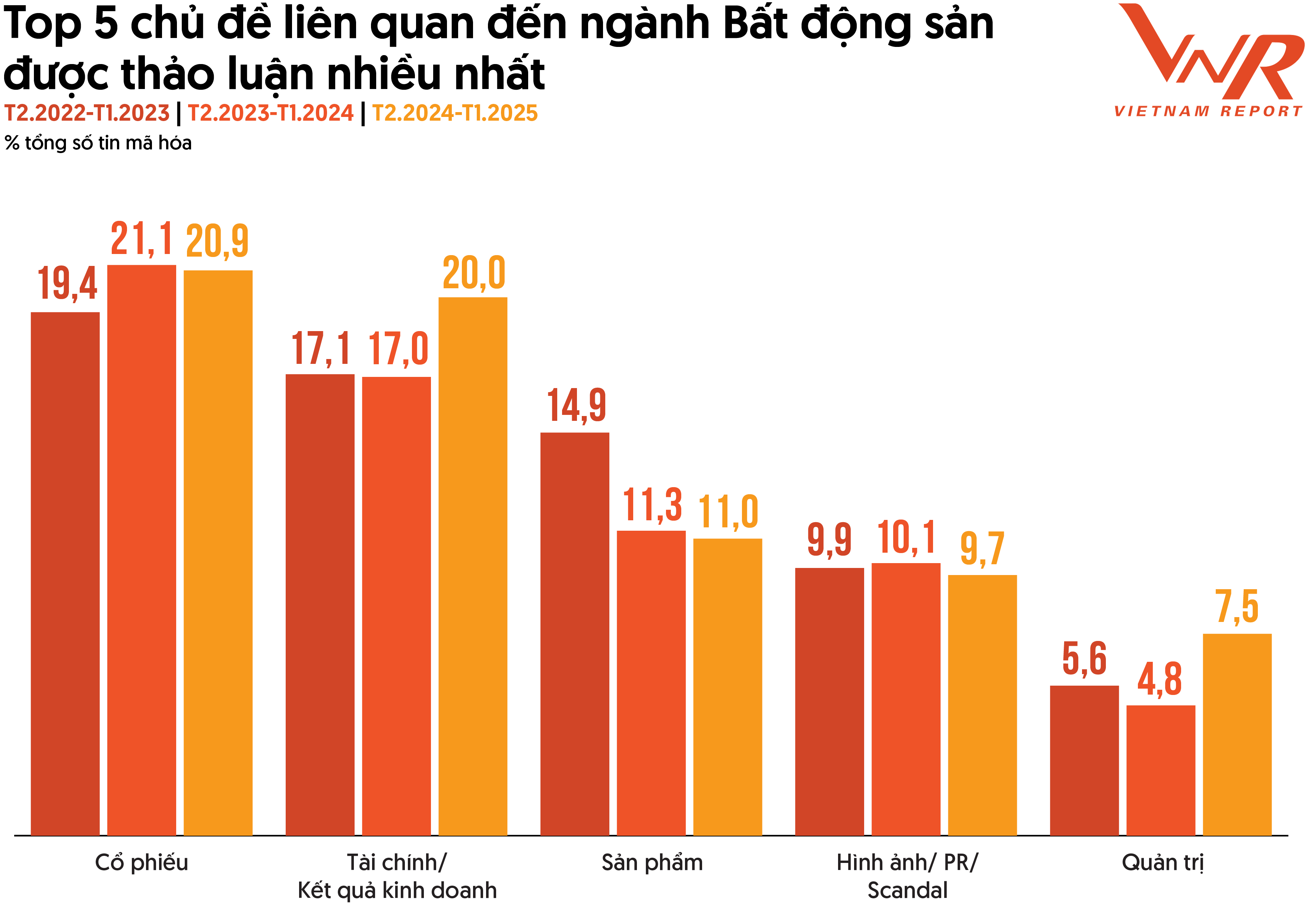

Figure 6: Top 5 Most Discussed Real Estate Topics (Feb 2022 – Jan 2025)

Source: Vietnam Report

The most covered topics included:

-

Stocks (20.9%)

-

Finance & Business Results (20%)

-

Products (11%)

-

Brand Image & PR (9.7%)

-

Corporate Governance (7.5%)

Coverage of corporate bonds drew increased attention, with 13.8% of articles referencing debt issuance or restructuring. The sector faces VND 130 trillion in maturing bonds in 2025—over half of the market’s total—including VND 56 trillion in previously extended terms. With many projects still facing delays, financial pressures remain a serious concern.

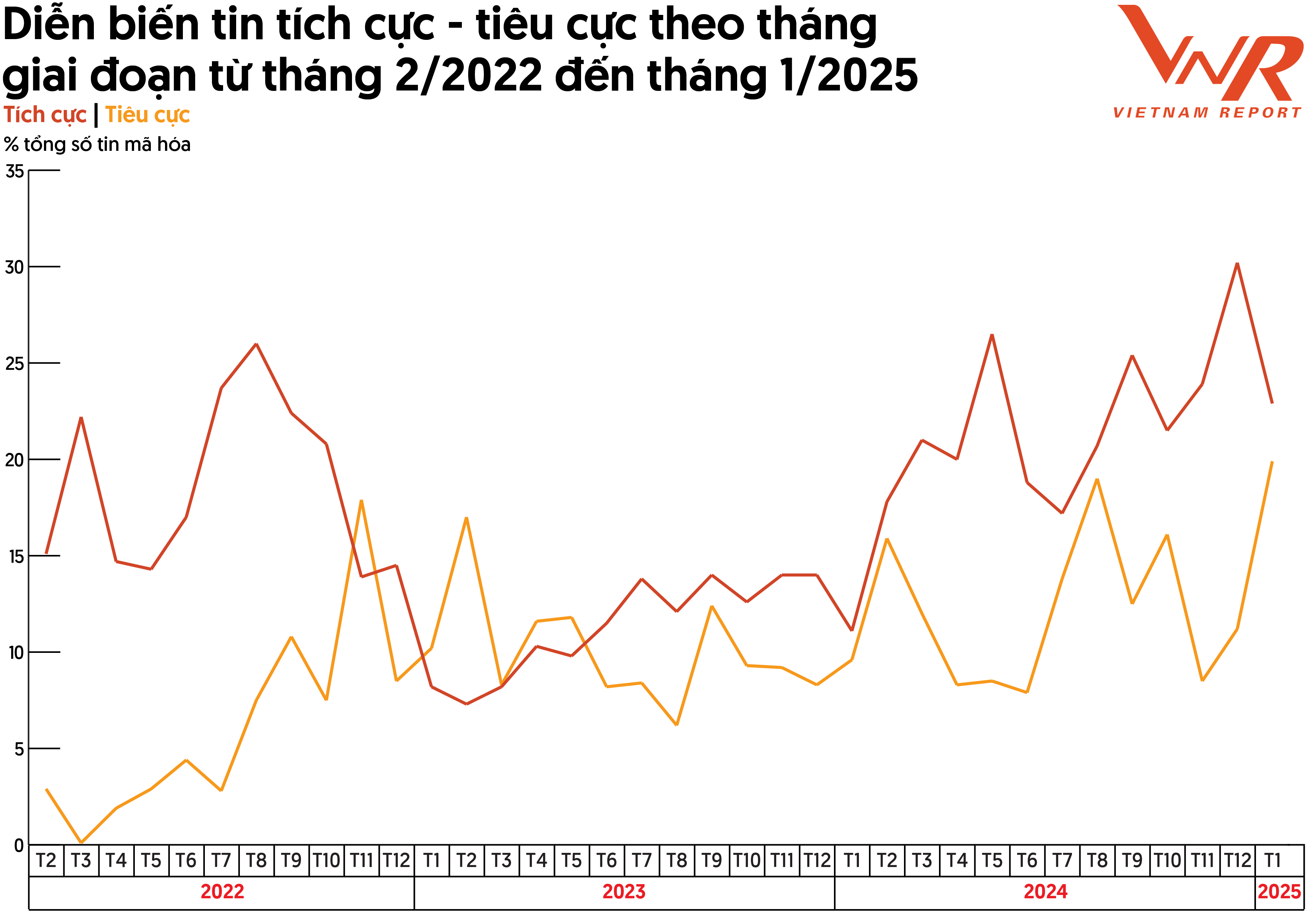

Figure 7: Monthly News Sentiment Trends (Feb 2022 – Jan 2025)

Source: Vietnam Report

However, sentiment is improving. Positive news coverage rose steadily in 2024, peaking at 30.2% in December, buoyed by favorable business results and confident forecasts for 2025.

Conclusion: A Year of Strategic Acceleration

With legal frameworks in place, macroeconomic conditions improving, and demand recovering, 2025 stands as a pivotal year for Vietnam’s real estate sector. Companies that adapt quickly—embracing transparency, innovation, and resilience—will be best positioned to lead the market into a new, sustainable growth era.

Source: Vietnam Report